The true cost of the Government’s proposed levy on international students

- The proposed 6% levy on international students’ fees could have a total cost of £621 million for England’s higher education institutions.

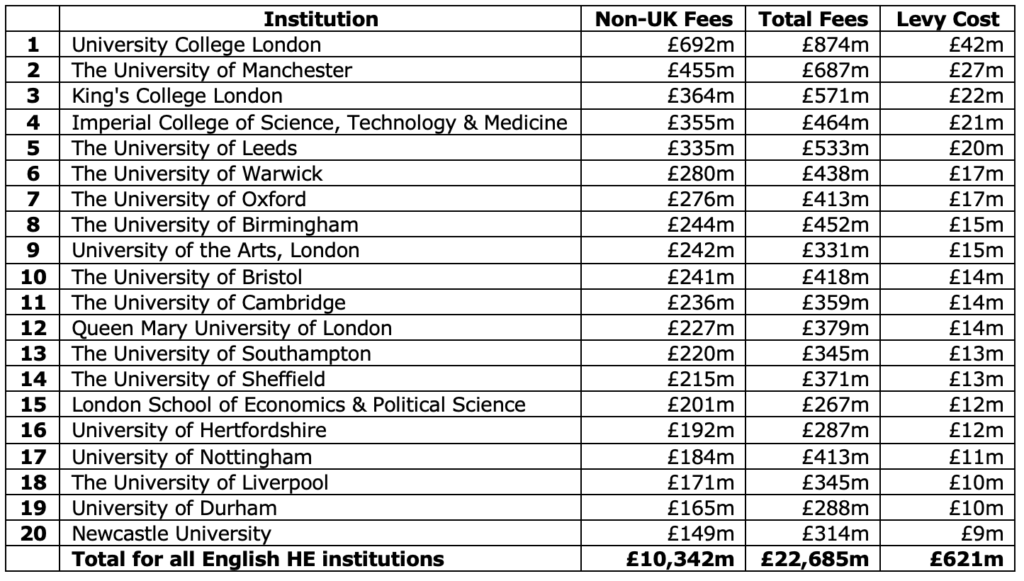

- The largest sums are expected to be faced by big metropolitan universities, such as UCL (£42 million), Manchester (£27 million) and KCL (£22 million).

- Universities could seek to absorb the costs, meaning less teaching / research, or they could try to pass them on, making the UK less competitive.

The UK Government’s Restoring Control over the Immigration System white paper (May 2025) proposes a 6% levy on international students’ tuition fees to invest in ‘the higher education and skills system’. Further details are expected in the autumn Budget.

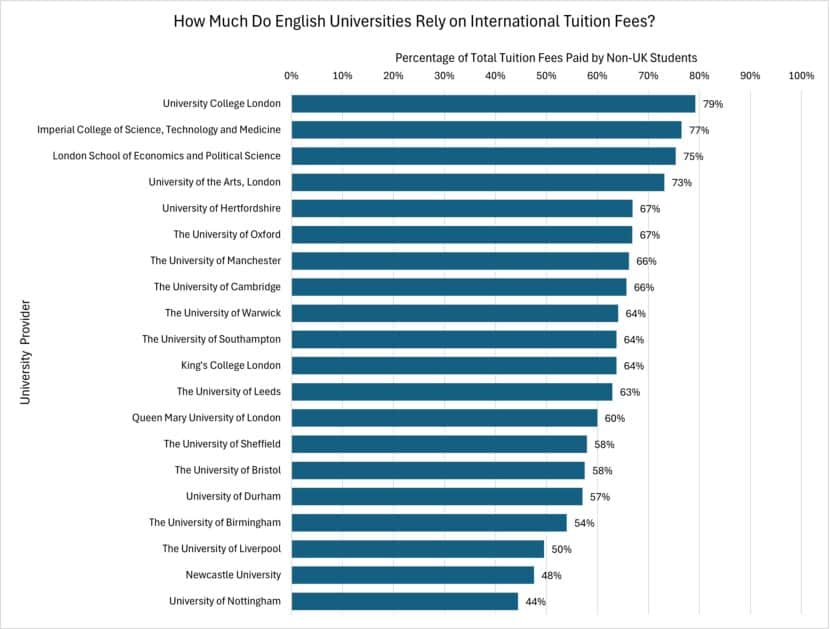

HEPI has used the latest available data (for 2023/24) to calculate the cost of the levy on affected institutions in England. Several derive over 70% of their fee income from non-UK students, such as University College London (79%), Imperial (77%) and the LSE (75%).

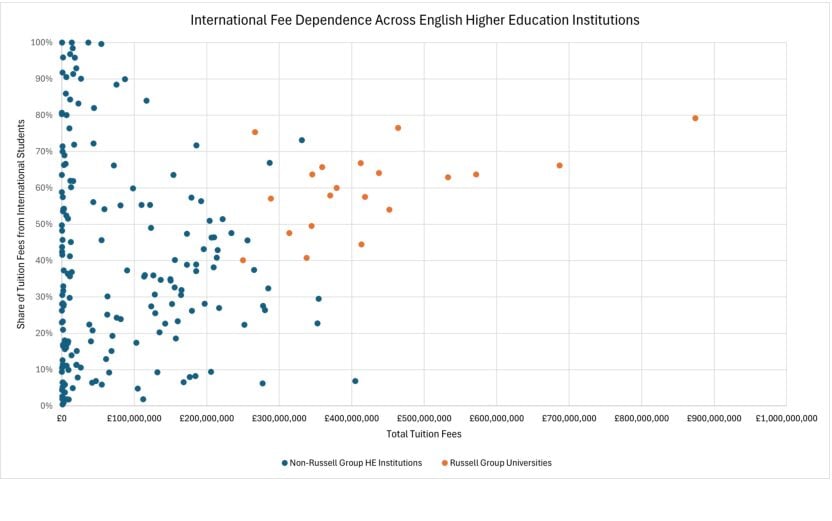

In total, the English higher education sector receives £10.3 billion a year in international fees. A levy would hit both large internationally engaged universities and smaller specialist institutions and, collectively, they would face new costs of just over £620 million a year.

The table below shows the levy’s impact on the most affected institutions. The levy could cost University College London £42 million, the University of Manchester £27 million and King’s College London £22 million, while 19 institutions would pay at least £10 million.

The UK higher education sector is already facing severe financial headwinds. The Office for Students has warned that 72 per cent of providers could be in deficit by 2025/26, with a total deficit of £1.6 billion.

Alongside other changes aimed at international students, such as a cut to the Graduate Route visa from two years to 18 months and tougher Basic Compliance Assessments, a levy on international students’ fees would damage the UK’s offer when the sector is under strain.

It is unclear to what extent higher education institutions would try to absorb the extra costs posed by the proposed new levy. Options include spending less on educating students or passing the costs on to students through higher fees, potentially reducing student numbers.

Currently, international student fees subsidise university-based research – for every £1 spent on research in the UK’s higher education institutions, only 67p is recovered through grants and contracts, leaving a shortfall of £6.2 billion.

This underfunding is expected to continue as public spending on research has been frozen (in real terms). So a new tax on student fees may lead to less research as well as a worse student experience.

We cannot know for certain how many international students there will be in future years, so these calculations are based on a steady-state situation. If international student numbers were to increase, the total raised by the levy could be higher.

The Government has said the money raised will be spent on higher education and skills. While this is vague, people within the higher education sector and beyond have proposed specific educational uses, such as using it to help ‘disadvantaged students from cold spots.’

Mark Fothergill, an independent researcher who has compiled the data, said:

‘International students are the backbone of our higher education system, contributing over £10 billion in fees to English universities – around £4.50 of every £10 of fee income. No wonder the 6% levy is seen as a tax on one of the country’s best-performing sectors.

‘The market for international students is competitive and a levy would hamper universities’ ability to compete with institutions in other countries. There are good reasons why Australia opted not to implement a levy when it was proposed there a couple of years ago.’

Nick Hillman OBE, the Director of HEPI, said:

The proposed levy on international students comes up in just about every meeting I attend. University leaders are worried it will be yet another weight dragging them down in the struggle to remain globally competitive.

‘The levy is designed to raise more money for the Government’s educational priorities but it is not clear if all the money will come back out of the Treasury, nor how it will be spent if it does.

‘Threatening an expensive new tax on one of the country’s most successful sectors with only a rough idea of how the money will be used seems far from ideal. Currently, the levy is a shadow looming large over universities as they prepare for the next academic year.’

Notes for Editors

The Higher Education Policy Institute (HEPI) aims to shape the higher education policy debate with evidence. UK-wide, independent and non-partisan, it is funded by organisations and universities that wish to see a vibrant higher education debate.

Comments

Tom says:

More detailed analysis back in May here: https://wonkhe.com/blogs/plotting-the-impact-of-an-international-fee-levy/

Reply

Richard Meredith says:

Loose talk costs lives. Behavioural effects of media coverage of what amounts to speculation will feed through to job cuts. Can’t this be communicated in confidential briefing to VCs.

Reply

David Palfreyman says:

Interesting indeed if any monies from what would be a new tax really finds its way to funding vocational FE – demonstrating that this Govt actually means business in rebalancing HE and FE as joined-up TE (albeit at the expense of the former)…

Reply

David says:

No mention of the NI increase that already hit unis hard, or how govts have forced us down the non British route. Trying to sabotage a 40 billion pound industry and a huge part of our history and soft power, to try and appease Daily Mail readers.

Reply

albert wright says:

Each University manages its own finance.

They must chose what to charge individual students and what they want to cross subsidies

The Government must not give them more money

Most of the overseas students will not stay in the UK so UK will not get taxes from them. UK tax payers will lose out. We should enrol more Uk students

Reply

kamir bouchareb st says:

thank you for this

Reply

Add comment