A Minimum Income Standard for Students

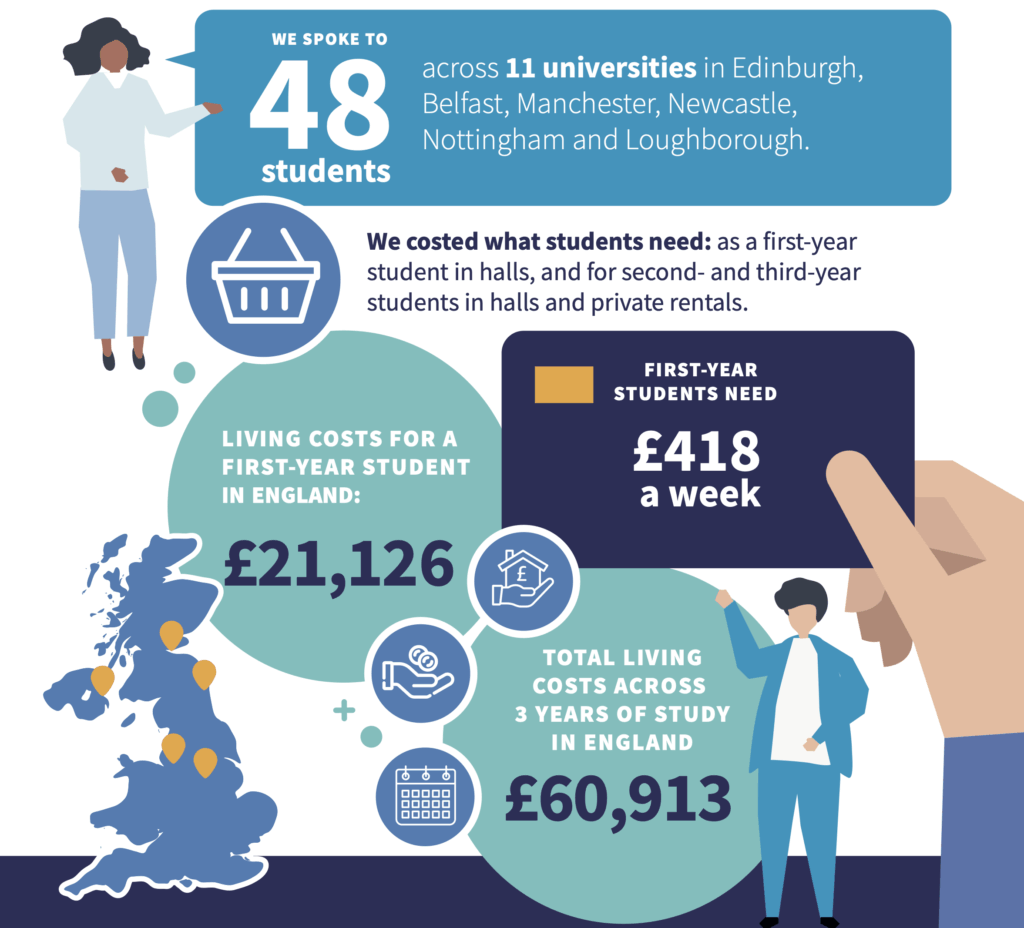

A new report from HEPI, TechnologyOne and the Centre for Research in Social Policy (CRSP) at Loughborough University shows how much first-year students need for a minimum socially acceptable standard of living that covers the basics and allows full participation in university life.

The Minimum Income Standard for Students is based on focus groups with students in university cities. These were used to price up a minimum basket of goods and services for students.

The report focuses in particular on first-year students in Purpose-Built Student Accommodation, such as halls of residence, but the results can be used to calculate the total costs of a full-time degree.

Key findings

- To have a minimum socially acceptable standard of living, a student needs £61,000 over the course of a three-year degree, or £77,000 if studying in London – all excluding fees.

- First-year students face higher costs than other students, due to one-off ‘setting-up’ costs (eg buying a laptop) as well as ‘settling-in’ costs (such as freshers’ week activities).

- For students in England, the maximum annual maintenance loan available to people from low-income households is £10,544 – this covers just half the costs faced by freshers.

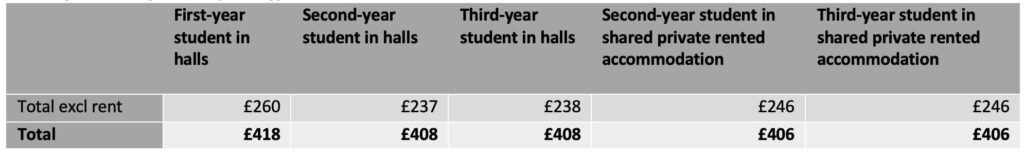

- Excluding rent, first-year students living in halls need £260 a week on average to cover living costs. With rent, students need an average of £418 a week.

- First-year students have a somewhat higher weekly budget than other students because there is a ‘first-year premium’ made up of: ‘setting-up’ costs – such as buying a laptop, kitchen equipment, bedding and other items needed throughout a degree; and ‘settling-in’ costs – such as freshers’ week activities and to build connections with other students while learning to live independently.

Average weekly costs for different students

- Costs vary around the country, meaning annual living costs for first-year students are £21,126 a year in England, £18,244 in Northern Ireland, £19,836 in Scotland, £20,208 in Wales and £24,900 in London. In London, rent makes up nearly half (46%) of students’ costs.

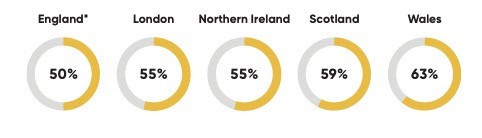

- For students domiciled and studying in England, the maximum maintenance loan (£10,544), which is only available to people from low-income households, covers just half (50%) of a first-year student’s true costs.

- Students living and studying in Scotland have 59% of their costs covered by the maximum maintenance support and those in Wales have 63% of their costs covered.

Proportion of first-year students’ costs covered by maximum maintenance support

- Those facing the biggest shortfalls are students from Scotland studying in London, as they receive no London weighting – their maximum maintenance support covers only 46% of their costs, leaving a shortfall of £13,500 a year.

- We also estimate the full living costs for a student over their entire degree. For a three-year degree, a student studying in England (outside London) will need around £61,000 to reach a minimum socially acceptable standard of living. A student studying in London would need around £77,000.

Total living costs, three-year degree, student who rents privately after first year

- These figures exclude tuition fees (generally £9,250 in England and Wales in 2024/25 but rising to £9,535 in 2025/26). With fees, a standard three-year degree in England can now cost around £90,000, or over £100,000 if the course is in London. Four-year courses cost commensurately more. However, home students can generally receive a tuition fee loan to cover the full amount of fees.

- The report also looks at how many hours of part-time work a student would need to do to reach the minimum acceptable standard of living: even when in receipt of the highest levels of maintenance support, students in England must work over 20 hours per week in term-time and vacations at the National Minimum Wage to meet the basic standard of living.

- The report recommends redesigning student maintenance support on the bases of simplicity, transparency, independence, sufficiency and fiscal neutrality.

In the concluding section of the report, Josh Freeman, one of the authors of the report, writes:

‘These findings demonstrate three serious risks to UK higher education: access to higher education becomes more unequal, the quality of the student experience suffers and the sustainability of the sector is put at risk.

‘The harm students currently face cannot be overstated. Too many students are struggling to cover their basic costs, let alone participate fully in higher education. It is not only good policy: there is a moral imperative to give students a fair chance of succeeding and thriving in higher education.’

Nick Hillman OBE, the Director of HEPI, said:

‘It is regrettable that we have had to calculate these numbers as, in an ideal world, there would already be a deep understanding of the true cost of being a student in the corridors of power. If there were, then student maintenance support would likely better reflect the actual costs of studying in 2025.

‘The total living costs while acquiring a degree now top £60,000 in England if the student is to receive the full benefits of higher education, and they are over £90,000 once tuition fees are included. In London, the total cost of a degree is over £100,000. Maintenance support is currently woefully inadequate, leading students to live in substandard ways, to take on a dangerous number of hours of paid employment on top of their full-time studies or to take out commercial debts at high interest rates.

‘We hope our results will lead to deeper conversations about the insufficiency of the current maintenance support packages, how much the imputed parental contribution should be and whether it is unreasonable to expect most full-time students to have to find lots of paid work even during term time. This new research will be of particular benefit to any policymakers, professors or parents trying to understand the stresses of being a young person today.’

Cheryl Watson, Education UK Vice President at TechnologyOne, said:

‘This research reveals a widening gap between the expectations students bring to university and the reality they encounter. With rising living costs and limited financial support, students are facing increasing challenges – and institutions are under growing pressure to deliver on the promise of student success.

‘We recognise that higher education institutions are working incredibly hard, often under complex and resource-constrained conditions. Staff are committed to supporting students, but without the right tools and insights it’s difficult to intervene early or drive meaningful outcomes.

‘Outdated systems can limit visibility and responsiveness. Supporting student success today requires more than incremental upgrades – it calls for modern, connected technology that gives institutions a full view of the student journey and enables timely and data-informed action.

‘As a partner to the sector, we believe technology should be seen not just as a back-office function, but as a strategic enabler of student success — helping universities enhance engagement, wellbeing and performance at scale. In a rapidly changing landscape, where the student experience is being redefined, institutions have a powerful opportunity to lead with innovation.’

Prof Matt Padley, Co-Director of CRSP and one of the authors of the report, said:

‘This new research gives us a clear picture of what students need, as a minimum, to cover the basics, but also to be able to participate in university life. Participating in the student experience – being able to socialise with friends, as well as joining clubs and societies – is important across all years at university.

‘But it is especially important in the first year to make these connections and establish friendships. Finding your feet as a first-year student is difficult enough without having to worry about balancing the costs of “settling in” against the cost of rent and food.

‘Having this clear evidence about the minimum needs and costs facing students throughout their time at university gives us a starting point for a much-needed conversation about the financial support currently provided to students. But it also points to the importance of discussing and addressing the key costs, outside of tuition fees, faced by students. Ensuring all students can meet their minimum needs is not just about increasing levels of financial support but is also crucially about looking at what can be done to reduce costs.’

HEPI and TechnologyOne will be hosting a free webinar on the cost-of-living for students and maintenance support levels on Wednesday, 10 September 2025 at 12.30pm. Register here.

Notes for Editors

- HEPI was founded in 2002 to influence the higher education debate with evidence. We are UK-wide, independent and non-partisan. We are funded by organisations and higher education institutions that wish to support vibrant policy discussions, as well as through our own events. HEPI is a company limited by guarantee and a registered charity.

- TechnologyOne is a global Software as a Service (SaaS) company. Their enterprise SaaS solution transforms business and makes life simple for universities by providing powerful, deeply integrated enterprise software that is incredibly easy to use. The company takes complete responsibility to market, sell, implement, support and run solutions for customers, which reduce time, cost and risk.

Comments

Paul Hyder says:

The comments above suggest that it is the government’s responsiblity to provide students with more money for maintenance grants but this is both unrealistic and irresponsible. The current Labour government is cash-strapped and has no money for education, with defense being the new priority. The answer is that universities and those supplying student accommodation must bring down their prices. The fact that students are having to work 20 hours a week just to meet the basic standard of living is simply wrong. Juggling work with study is very difficult, and it is why why we are seeing so many students suffering mental health issues at our universities up and down the country. Finally, a total of 639,000 people with an honours degree or similar level qualification are claiming Universal Credit, according to the first data of its kind released to Parliament in July 2025. Typically students will graduate with a debt of around £55,000 so it would seem that students need to be made aware of the shortfalls of going to university. Graduate earnings are higher than non-graduate earnings, but how much you earn depends on what you study. Thus, there are significant differences in returns by subject, with evidence repeatedly showing that a degree in Medicine and Dentistry or Economics is likely to attract much higher pay than a degree in the Humanities or Creative arts. Unfortunately, the for-profit model in eduation has led to dire consequences for students and for HE staff who are losing their jobs as a result of managers engaging in so-called SMART management strategies to save money.

Reply

Richard Clarke says:

Not sure if I’m missing something, but how do you get to the figure of £61000 over 3 years? I have 2 children at Manchester University. I top up their maintenance load so that they have about £10,500 each per year. They have part time jobs, but that would only add between £500 and £1000 per year. Even at £1000 from part time jobs, that means they live on £11,500 per year. They have decent accommodation and seem to have plenty to live and socialise. So 3 years at this level means they only need £34,500, not the £61,000 calculated in this report.

Reply

Replies

Nicky Savage says:

I agree with you there Richard. I’m a medicine graduate and spent in the ballpark of £10,000 to £11,000 with the highest year I had £14,000 in income due to supplementation from a part time job. I was able to save the extra.

Reply

Add comment